Payment processing is one of the most crucial issues in e-commerce. A study by Sendcloud sums it up: 53% of all potential customers abandon their purchase if they don't find their preferred payment method in the checkout process.

Thanks to Shopify Payments, Shopify merchants have it particularly easy to ensure a straightforward payment process for their customers. But what is Shopify Payments and why do we consider it an absolute must-have?

In our comprehensive guide, Adrian explains the essentials for getting started with Shopify Payments, covering features, benefits, and potential problems in detail. You'll also learn everything about fees and how to set up Shopify Payments for your online store.

1. What is Shopify Payments?

Shopify Payments is Shopify's integrated payment solution. It lets you offer the most important payment methods directly in your online store without relying on third-party providers. The tedious setup of external payment services and merchant accounts is a thing of the past.

As an integral part of all Shopify plans, Shopify Payments is available immediately after setting up your online store – fully functional and at no additional cost. Activation takes just a few steps, so you and your customers can quickly benefit from an efficient and reliable payment process.

2. What payment methods does Shopify Payments include?

Shopify Payments includes the most popular payment methods in Germany, Austria, and Switzerland. These include:

- Credit cards (VISA, MasterCard, Maestro, AMEX)

- Klarna invoice

- SOFORT transfer

- Apple Pay

- Google Pay

- Amazon Pay

- Meta Pay

- Shop Pay

- Transfers with EPS

Does Shopify Payments support Paypal?

No, PayPal is not included by default in Shopify Payments. However, you can of course integrate other payment providers into your online store besides Shopify Payments, so this isn't a problem.

We strongly recommend adding PayPal as an additional payment option as it is the most popular payment method in Germany.

3. What are the benefits of Shopify Payments?

a. No complex setup

With Shopify Payments, you can get started right away: Activate it in your admin area in just a few clicks. After that, the most important payment methods for your store are available to you without any further effort.

Cumbersome verification and setup processes for business accounts and their connection to Shopify are completely eliminated. This saves you valuable time and allows you to focus entirely on promoting your products.

b. No additional transaction fees

In our opinion, the main reason for Shopify Payments: Once activated, you save Shopify's own transaction fees.

There are basically two types of variable costs in online commerce. First, there are transaction fees that you pay to external providers, for example, when your customers pay by credit card or Klarna invoice. These vary depending on the payment method used and the Shopify pricing plan.

In addition to these regular costs, Shopify's own transaction fees apply. These also vary from plan to plan.

The big advantage, however, is that these Shopify-specific fees are completely eliminated once you activate Shopify Payments. This applies even if your customers use other payment methods, such as PayPal. For these cost savings alone, we definitely recommend using Shopify Payments.

You can find more information about Shopify costs and an overview of all pricing plans in our guide.

c. Complete checkout in your own shop

With Shopify Payments, the entire checkout process takes place within your own store, without redirecting customers to external third-party sites. This eliminates additional hurdles such as additional logins or pop-ups and reduces the risk of cart abandonment.

You are also independent of the availability of external services: Shopify Payments has an uptime of 99.99%, making it extremely reliable.

d. High security standards & integrated fraud protection

The secure and trustworthy handling of payment data is an absolute must for online retailers. Shopify Payments guarantees that your store meets the highest security standards right from the start.

Shopify Payments protects all payment data with comprehensive encryption. Credit card information is handled according to the PCI DSS Level 1 standard, ensuring PCI compliance. Additionally, 3D Secure technology minimizes the risk of credit card fraud and incorrect data entry.

Shopify Payments also offers advanced fraud analysis, which allows you to detect criminal activity based on specific indicators such as AVS checks, card security numbers, and IP address details. You can view a detailed analysis for each order.

Basic fraud analysis is built into every Shopify pricing plan. Starting with the Shopify plan, you get fraud recommendations as an additional feature. This provides an assessment of chargeback risk due to fraud based on learning algorithms.

e. All transactions at a glance

With Shopify Payments, you have a clear overview of all transactions in a single, easy-to-use dashboard. You save yourself the hassle of logging into various third-party accounts to get a complete picture.

Instead, get a complete overview of all payments with just one click in the central Shopify Payments interface.

f. Perfect for global trade

If you sell internationally, we believe Shopify Payments is essential. With support for more than 130 currencies, your customers can easily pay in their own local currency.

Shopify Payments' multi-currency capability improves the shopping experience for international customers while increasing their willingness to make payments in your online store.

Essential sales tools for global commerce are also linked to Shopify Payments. These include Shopify Markets for identifying, managing, and optimizing international markets, as well as access to local payment providers. Overall, Shopify Payments offers you an excellent foundation for trading beyond the DACH region.

g. Support for physical sales

If you sell products in-store in addition to your online business, Shopify Payments is also an ideal solution for payment processing.

With Shopify POS, Shopify's integrated point-of-sale system, you can easily accept payments in your local store, at trade shows, or in pop-up stores. Best of all, Shopify Payments is integrated directly into Shopify POS. This way, you always have an overview of all transactions – whether online or offline.

You can find out everything you need to know about Shopify POS in our comprehensive guide.

h. Accelerated checkout

Reduce abandoned carts with a particularly fast payment process for your customers. Shopify Payments seamlessly integrates express checkouts such as Apple Pay, Google Pay, and Shopify's own Shop Pay.

Customers no longer have to manually enter their payment information for each purchase and appreciate the convenient and quick processing.

4. Instructions: Set up Shopify Payments in 4 steps

Follow these simple steps to activate Shopify Payments for your online store:

a. Checking your bank account

- Make sure your bank account meets Shopify's requirements. It must be a checking account that accepts transfers in your region's currency and allows electronic payments.

- Please note that Shopify does not support savings accounts, flex-currency accounts, or similar services. For a German account, it is important that it is denominated in euros, accepts SEPA transfers, and has a valid IBAN.

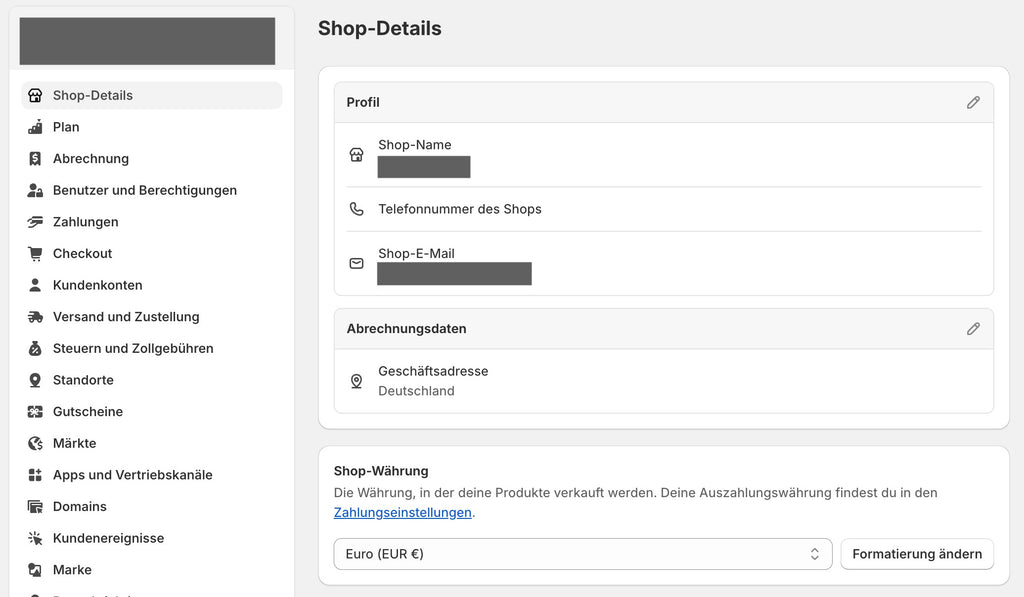

b. Set your shop's currency

- Choose a currency in which to display the prices of your products.

- Go to Settings -> Shop Details and select the currency.

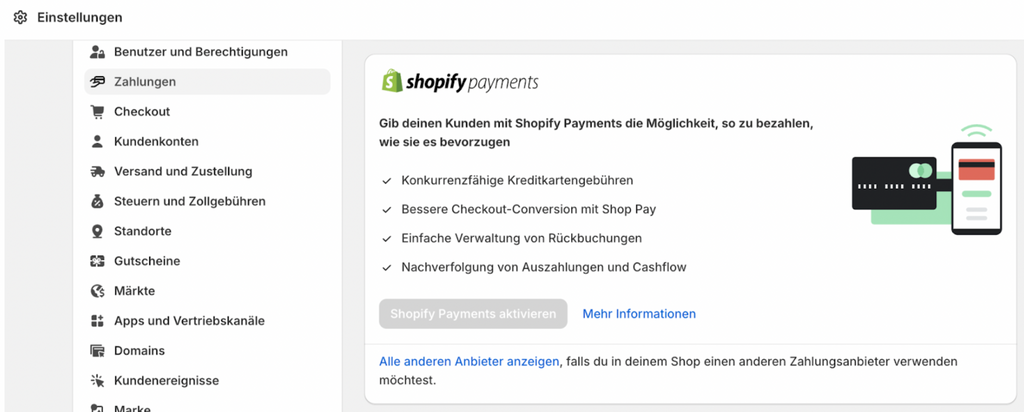

c. Activating Shopify Payments

- In your Shopify admin, go to Settings > Payments.

- Activate Shopify Payments. If you haven't set up a credit card payment provider yet, click 'Complete account setup' in the Shopify Payments section. If you've already activated another provider, select 'Activate Shopify Payments' and confirm your selection.

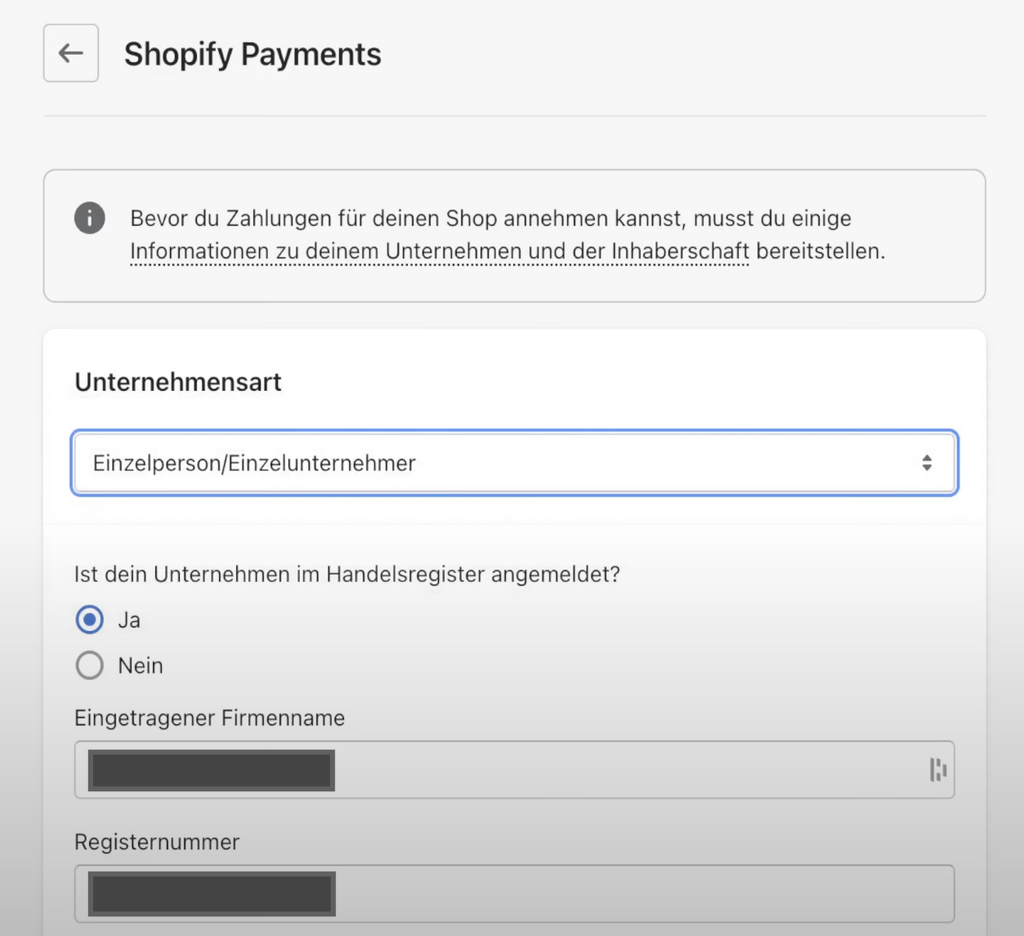

d. Enter your business details

- Fill out the required information about your business. If it's a registered business, make sure all information matches the dates you founded your business.

- Then enter your personal details as they appear on your ID card and your IBAN.

- You can then complete the account setup.

After you've successfully set up Shopify Payments, your customers can shop and pay using the most popular payment methods. Please note that accurate and complete information is essential for smooth verification and use of Shopify Payments.

In the Shopify admin area under 'Settings' > 'Payments' you can make configurations to Shopify Payments at any time, e.g. adjusting the payment methods or the payout schedule (daily, weekly, monthly).

5. What are the disadvantages of Shopify Payments?

a. Chargeback fees

In Germany, Shopify Payments charges a fee of €15 for each chargeback, which may result from, for example, canceled credit card payments. However, this fee is industry standard, and canceled credit card payments are not common in practice.

b. Frozen posts during reviews

When investigating chargeback errors or suspicious activity, Shopify Payments may temporarily freeze your funds. You will then temporarily lose access to these funds during this review process.

In such situations, we recommend contacting Shopify Support immediately. The support team is available 24/7 via phone or chat and will help you resolve the issue quickly.

6. FAQ: The most important questions about Shopify Payments

a. In which countries is Shopify Payments available?

Shopify Payments is available in 23 countries, including:

Germany, Austria, Switzerland, United Kingdom, France, Italy, Spain, Netherlands, Belgium, Denmark, Sweden, Finland, Portugal, Ireland, Romania, Czech Republic, United States, Canada, Australia, New Zealand, Singapore, Japan, Hong Kong (Special Administrative Region).

b. Can any business use Shopify Payments?

Shopify Payments' Terms of Service exclude certain items and services. Prohibited industries include:

- Financial products and services in the areas of money transfer, virtual cryptocurrency, check cashing and credit card repair

- Products for adults

- Fake pharmaceuticals

- Gambling-related products and services such as sports betting, lotteries and competitions

- Products that infringe copyright and trademark rights

- some difficulties with CBD products

c. How do I receive payments with Shopify Payments?

Shopify Payments pays all transactions to your registered bank account within 3-4 business days, so you don't have to wait long for your money.

If you prefer monthly billing, you can configure this to your liking in the Shopify Payments settings.

d. Can I run tests on Shopify Payments?

Shopify Payments offers you a test mode to simulate how orders are processed in your online store.

Activate test mode in your settings under 'Payments' > 'Shopify Payments'. You can then perform test transactions.

Make sure to deactivate test mode afterwards so that real customers can pay with credit cards again.

e. Is there a maximum limit for Shopify Payments?

No, Shopify Payments does not set a maximum amount you can accept in payments.

7. Conclusion

Shopify Payments is the ideal way to provide your customers with a smooth and seamless payment experience: Independent of external providers and without administrative overhead, you offer the most important payment methods directly in your store.

In our opinion, the biggest advantage of Shopify Payments is its deep integration into the Shopify ecosystem. Simply activating it saves you the additional transaction fees typically associated with using external payment gateways. You also keep track of all payments from different providers in one central dashboard.

Shopify Payments also meets specific needs, such as seamless integration with brick-and-mortar stores thanks to Shopify POS or trading with international customers. While it doesn't include PayPal by default, you can add this popular payment method to your online store.

Since Shopify Payments is also characterized by high security and reliability, it is our clear recommendation for modern e-commerce businesses.